Borrowing Costs and Housing Supply

Impacting the Market!

The first quarter of 2022 saw the worst quarter for affordability in Canada which rose by 3.7 percentage points to 54.0%. In each and every market we monitor, ownership costs went up, however buyers may feel the effects differently depending on location.

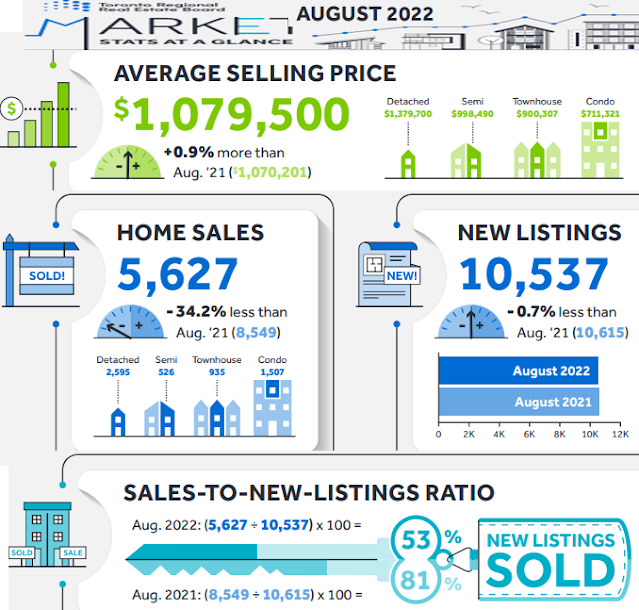

In the 2nd quarter total house sales in the GTA were 5,627, down 34% from the same time last year. but a gain when compared to July and when seen month-over-month.

Over the last year, the rental market for condominium apartments has become much more competitive. 1 Bedroom and 2 Bedroom apartment average rentals have reached record highs, surpassing the historical record in the third quarter of 2019.

In the 2nd quarter of 2022, there were 13,203 condo unit rentals reported by the Toronto Regional Real Estate Board, which is a decrease of 11.4% from the 2nd quarter of 2021. The decline in rents was not caused by a decline in demand, but rather a considerably more noticeable decline in the number of rental listings, which fell by approximately 30% on a yearly basis. Renters found it far more difficult to negotiate agreements since they had fewer options.

In the coming months, the rental market’s circumstances are likely to get much tougher. Some people may have been temporarily prevented from buying a house by higher borrowing prices, but the Greater Toronto Area’s population is still expanding along with the region’s growing economy.

This indicates that the rental market will see an increase in the number of people looking for housing. For all kinds of bedrooms, the average condo rent increased by double digits yearly in the second quarter.

The typical rent for a 1 Bedroom unit rose by 20.2% annually to $2,269. The average 2 BR rent increased by 15.3% during the same time frame to $2,979. Rent averages are under intense increased pressures as a result of growing renter demand.

The Greater Toronto Area’s ongoing rental shortage will become worse in the near future as more and more privileged people choose to live in rental properties. Whether we’re talking about investor-held condominium apartments or developments built specifically for renting out, policymakers need to come up with a variety of solutions to increase the rental supply online.

If you want to save money and get ahead of inflation, you should not wait for 2023. The interest rate increase and inflation may make the house more expensive in the future. If you sell your house now, you can make more money than waiting until 2023.

If you have been considering Buying, Selling, or Renting your home or have avoided the notion due to a negative experience, let Arsh Syed, a Real Estate Agent in Toronto, manage the deal.

His experience and understanding have been indispensable. He desires Toronto’s housing crisis to improve. He wants to establish relationships and spread the word about his exceptional service, increasing the likelihood that renters and property owners would place their faith in him.

Arsh wants property owners to know that by hiring him, they are drastically reducing risks, saving time and saving money.

For further information about his services, please visit

www.arshsyed.ca or contact (416) 844-2217.

For more interesting blogs, please visit: